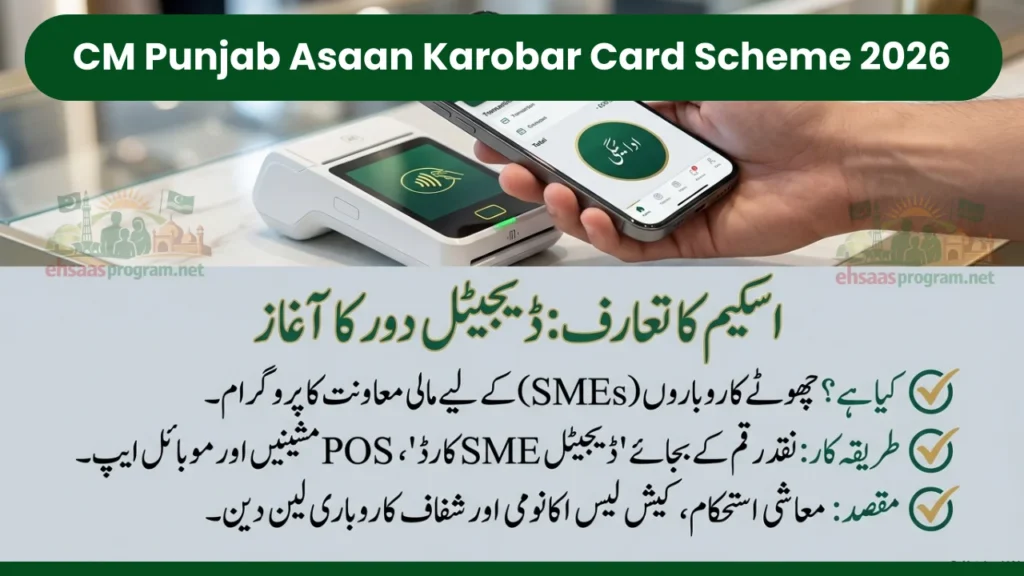

The CM Punjab Asaan Karobar Card Scheme 2026 is a flagship financial inclusion initiative launched by the Government of Punjab to empower small entrepreneurs and emerging businesses across the province. Under this scheme, eligible applicants can access interest-free loans of up to PKR 1 million through a digital SME card, enabling transparent, cash-controlled, and business-focused financing.

The program is designed to support both existing and prospective small businesses by offering structured funding through digital channels, including POS machines, mobile applications, and controlled cash withdrawals, ensuring responsible use of funds and long-term business sustainability.

Objectives of the Asaan Karobar Card

The core objectives of the scheme include:

- Promoting small and medium enterprise (SME) growth in Punjab

- Providing interest-free financial access to entrepreneurs

- Encouraging digital and transparent business transactions

- Reducing dependency on informal lending

- Supporting job creation and economic stability

Read More: CM Punjab Asaan Karobar Finance Scheme 2026 – Interest-Free Loans for SMEs

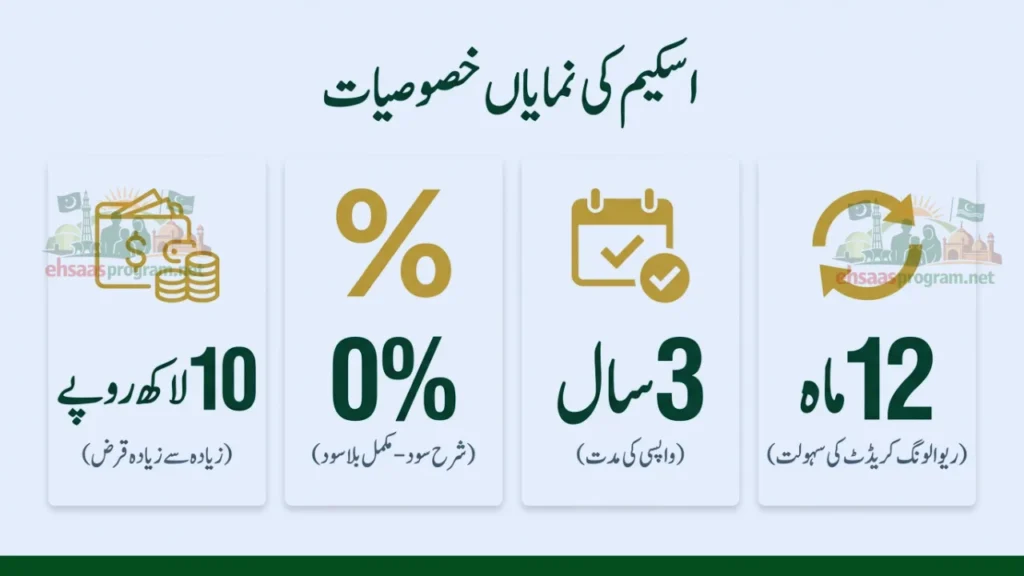

Key Features of CM Punjab Asaan Karobar Card

| Feature | Details |

|---|---|

| Maximum Loan Limit | PKR 1,000,000 |

| Loan Tenure | 3 Years |

| Loan Type | Revolving Credit Facility (First 12 Months) |

| Repayment Period | 24 Equal Monthly Installments |

| Grace Period | 3 Months from Card Issuance |

| Interest Rate | 0% (Interest-Free) |

Permitted Usage of Loan Amount

Funds issued through the Asaan Karobar Card can only be used for legitimate business purposes, including:

- Vendor and supplier payments

- Utility bills

- Government fees and taxes

- POS-based digital payments

- Cash withdrawal up to 25% of the approved limit for miscellaneous business needs

⚠️ Personal, entertainment, or non-business transactions are strictly blocked.

Eligibility Criteria

Applicants must meet the following requirements to qualify for the scheme:

- Small entrepreneurs operating or planning a business in Punjab

- Age between 21 to 57 years

- Pakistani national and resident of Punjab

- Valid CNIC and mobile number registered on the applicant’s CNIC

- Existing or proposed business located within Punjab

- Satisfactory credit profile and psychometric assessment

- Clean credit history with no overdue loans

- Only one application per individual and business is allowed

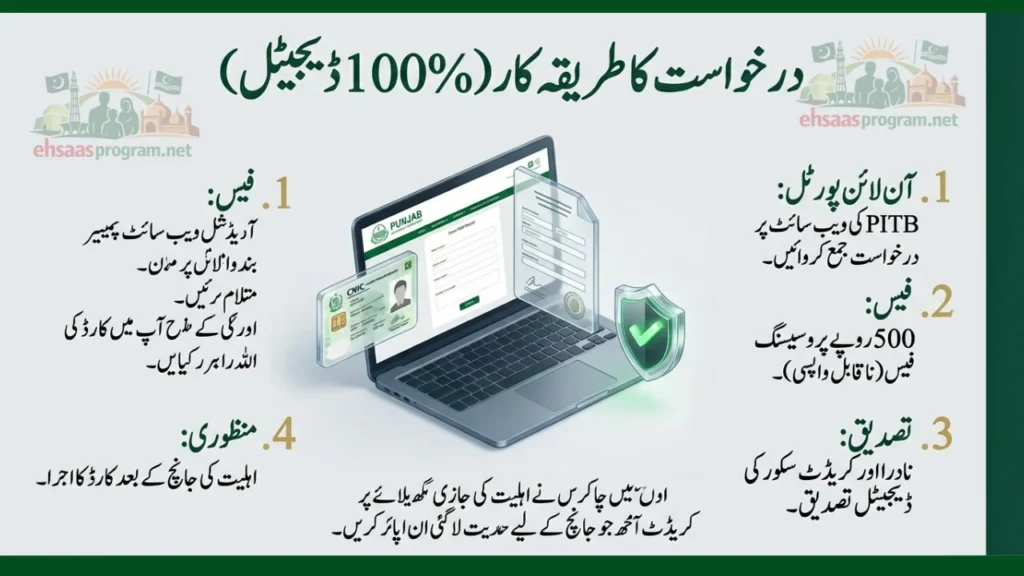

How to Apply for CM Punjab Asaan Karobar Card

The application process is 100% digital and involves the following steps:

- Submit the application through the PITB online portal

- Pay a non-refundable processing fee of PKR 500

- Digital verification of CNIC, credit score, and business premises

- Psychometric and eligibility assessment by authorized agencies

- Card issuance upon approval

Official Website

👉 https://akc.punjab.gov.pk/cmpunjabfinance

For assistance and inquiries:

📞 1786

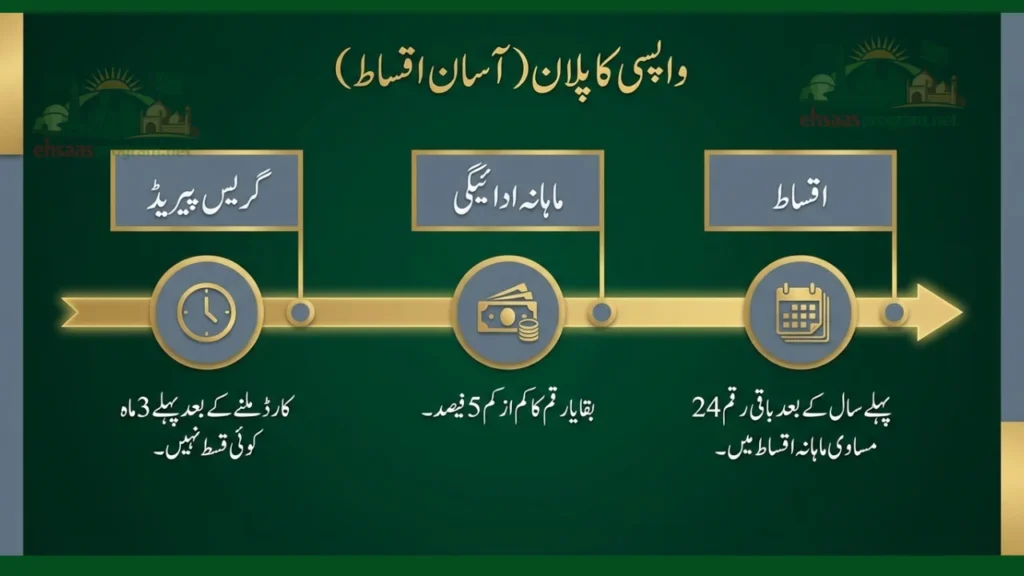

Loan Disbursement & Repayment Structure

Disbursement Phases

- First 50% Limit:

Available for use within the first 6 months - Second 50% Limit:

Released after:- Satisfactory utilization

- Regular repayments

- Mandatory registration with PRA / FBR

Repayment Terms

- Grace period of 3 months after card issuance

- Monthly minimum payment of 5% of the outstanding principal

- Remaining balance after the first year repaid over 24 Equal Monthly Installments (EMIs)

Charges & Fees

| Charges | Details |

|---|---|

| Annual Card Fee | PKR 25,000 + FED (deducted from approved limit) |

| Processing Fee | PKR 500 (Non-Refundable) |

| Additional Costs | Life assurance, card issuance & delivery covered |

| Late Payment Charges | As per Bank’s Schedule of Charges |

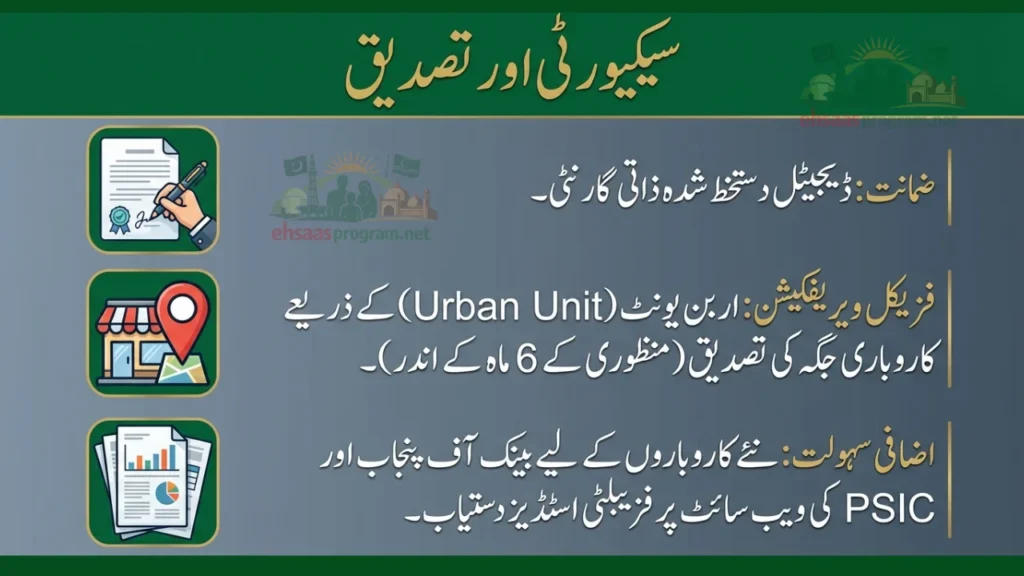

Security & Verification Measures

- Personal guarantee digitally signed by the borrower

- Life assurance is included in the loan portfolio

- Physical verification of business premises by Urban Unit:

- Within 6 months of approval

- Annually thereafter

Conclusion

The CM Punjab Asaan Karobar Card Scheme 2026 is a significant step toward strengthening Punjab’s small-business ecosystem. By offering interest-free financing, digital controls, and structured repayments, the program ensures financial discipline while empowering entrepreneurs to grow sustainably. Eligible business owners are strongly encouraged to apply online and take advantage of this government-backed opportunity to expand their ventures without the burden of interest.