The CM Punjab Asaan Karobar Finance Scheme 2026 is a major economic empowerment initiative launched by the Government of Punjab to support Small and Medium Enterprises (SMEs) across the province. The program provides interest-free financing to encourage entrepreneurship, job creation, exports, and sustainable business growth, particularly in priority and climate-friendly sectors.

This scheme is designed to strengthen Punjab’s business ecosystem by offering accessible funding for startups, existing businesses, modernization projects, logistics, and renewable energy solutions, while ensuring transparency, affordability, and long-term economic impact.

Why the Asaan Karobar Finance Scheme Was Introduced

The key objectives of the program include:

- Promoting entrepreneurship and self-employment

- Supporting SMEs to expand and modernize operations

- Creating new job opportunities across Punjab

- Encouraging exports and productive economic activity

- Supporting climate-friendly and RECP (Resource Efficient & Cleaner Production) technologies

Read More: CM Punjab Asaan Karobar Card Scheme 2026

Loan Purposes

Under the CM Punjab Asaan Karobar Finance Scheme, loans can be availed for the following purposes:

New Businesses

- Startup funding

- Initial capital for setting up operations

Existing Businesses

- Business expansion

- Modernization and upgradation

- Working capital requirements

Leasing & Logistics

- Commercial logistics

- Leased commercial vehicles

RECP & Climate-Friendly Businesses

- Renewable energy projects

- Environment-friendly technologies

- Sustainable production solutions

Eligibility Criteria

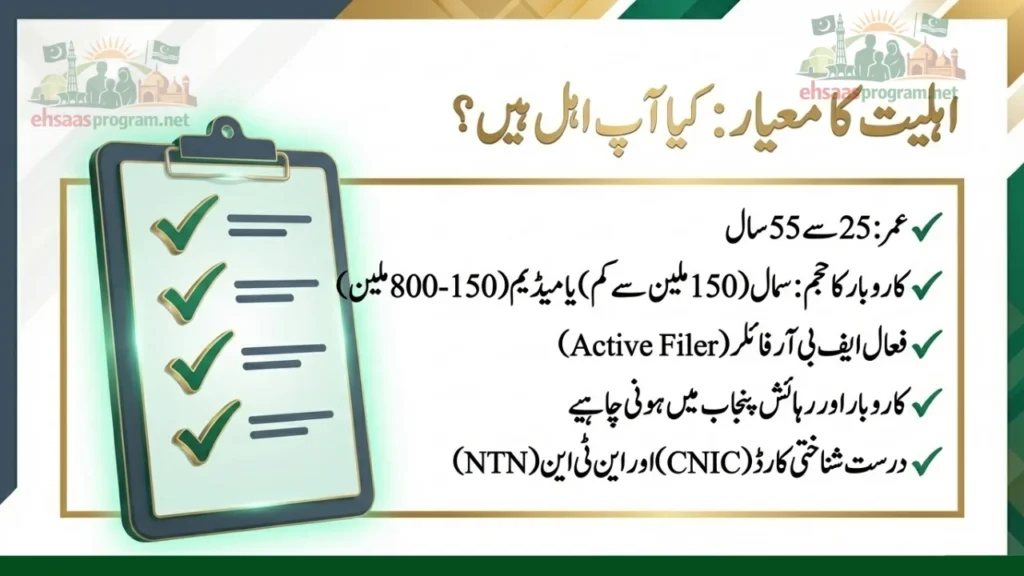

Applicants must fulfill the following eligibility requirements:

- Small Enterprises:

Annual sales up to PKR 150 million - Medium Enterprises:

Annual sales between PKR 150 million and PKR 800 million - Age between 25 to 55 years

- Active FBR tax filer with a clean credit history

- Residence and business must be located in Punjab

- Valid CNIC and NTN

- Ownership or legally rented premises for existing businesses

Loan Tiers & Financing Details

| Tier | Loan Amount (PKR) | Security | Tenure (Up to) | End-User Rate | Processing Fee |

|---|---|---|---|---|---|

| T1 | 1M – 5M | Personal Guarantee | 5 Years | 0% | PKR 5,000 |

| T2 | 6M – 30M | Secured | 5 Years | 0% | PKR 10,000 |

Grace Period

- Startups / New Businesses: Up to 6 months

- Existing Businesses: Up to 3 months

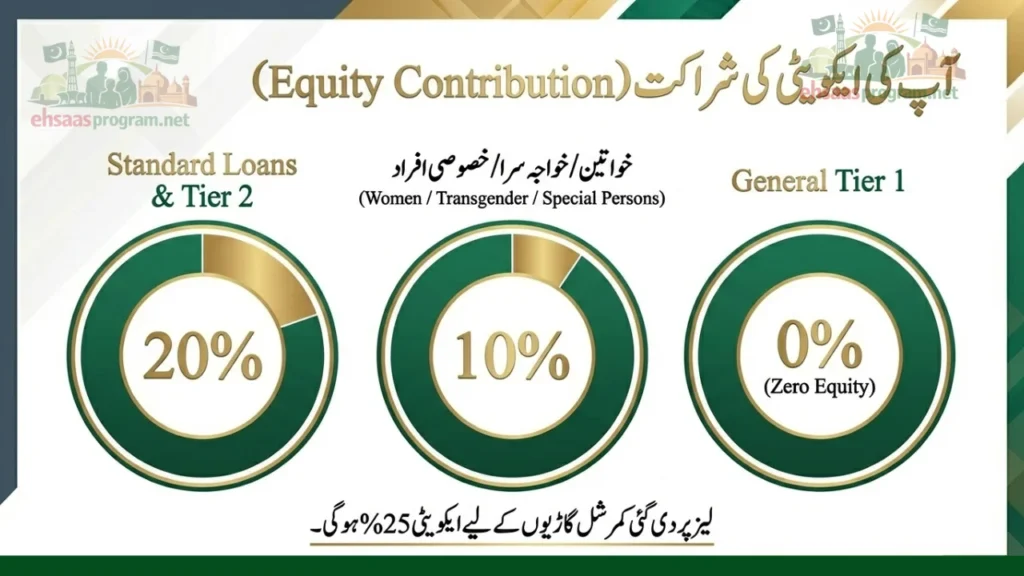

Equity Contribution

- T1 (General): 0%

- Leased Commercial Vehicles: 25%

- Other Loans (T1 & T2): 20%

- Special Category (Females, Transgender & Differently-Abled): 10%

Repayment Terms

- Repayment through equal monthly installments as per approval terms

- Late Payment Charges:

PKR 1 per 1,000 per day on overdue amounts

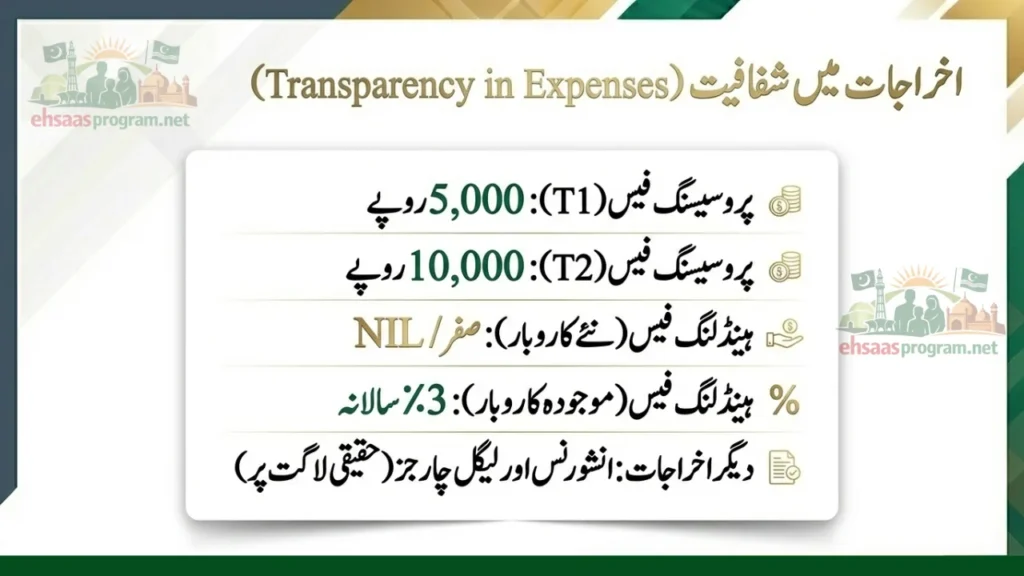

Additional Costs & Charges

- Handling Fee:

- NIL for setting up new businesses

- 3% per annum for existing businesses

- NIL per annum for climate-friendly businesses (T2 only)

- Other Charges:

- Insurance costs

- Legal documentation charges

- Registration charges (as per actual cost)

How to Apply for CM Punjab Asaan Karobar Finance

Applicants can apply online through the official portal by submitting the required personal, business, and financial details. After submission:

- Application screening and verification

- Credit and eligibility assessment

- Approval and loan sanction

- Disbursement as per the approved tier and terms

Official Website

👉 https://akf.punjab.gov.pk/cmpunjabfinance

For guidance and support:

📞 1786

Conclusion

The CM Punjab Asaan Karobar Finance Scheme 2026 is a transformative initiative aimed at strengthening SMEs and accelerating Punjab’s economic growth. By offering interest-free loans, flexible repayment terms, and targeted support for startups and climate-friendly businesses, the scheme removes major financial barriers faced by entrepreneurs. Eligible business owners are encouraged to apply and leverage this opportunity to scale operations, create employment, and contribute to a stronger provincial economy.